During periods of monetary tightening, the riskiness of corporate sector firms may increase. The magnitude of this increase depends not only on the intensity of the tightening but also on the firms’ financial conditions at its outset. This blog post analyzes the riskiness of the corporate sector during the latest tightening period, with a particular focus on house sales to explore whether firms choose to sell their assets to avoid liquidity issues.

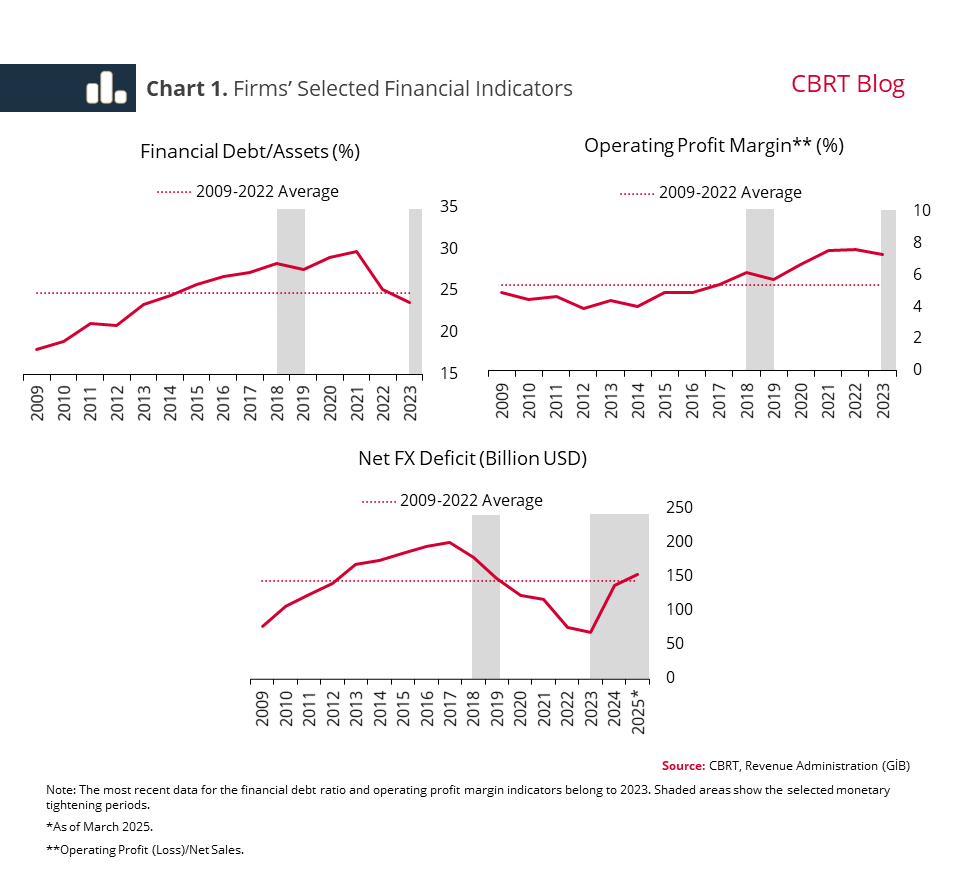

Firms faced the current cycle with relatively low levels of debt and high profitability (Chart 1). The ratio of financial debt to assets, which had been rising since 2009, peaked in 2021, then declined sharply and fell below historical averages in 2023. Moreover, the operating profit margin maintained its historically high levels, while the net FX deficit receded notably. This indicates that the corporate sector has entered the recent tightening episode with a strong financial buffer. However, the decline in the profitability of firms suggested by the leading indicators[1] and the widening of the net FX deficit should also be noted.

This financial strength is also reflected in default risk indicators. In fact, despite a slight uptick in the first months of the tightening, the returned check rate remained well below its historical average, and edged down after August 2024 (Chart 2). Similarly, the ratio of firms’ non-performing commercial loans receded to historically low levels at the end of 2023. Although this ratio has recently inched up, it still remains far below its long-term average (Chart 3). In short, recent data suggest that the corporate sector default risk has not registered a significant increase during the current tightening period.

Beyond financial buffers, the favorable outlook in default could be a result of asset liquidation. To test this hypothesis, we use data on firms’ property sales. If companies are turning to asset sales, a reasonable first step is to dispose of residential properties that are not used in production, were acquired in exchange for trade receivables, or were purchased for investment purposes. Moreover, construction companies—whose end product is housing— may, in the presence of default risk, try to quickly liquidate their housing inventory in order to strengthen their cash assets.[2] Therefore, during periods of monetary tightening, housing sales by firms can be expected to increase more than those by individuals.

Against this background, using land registry data, we estimate the share of firms (as legal persons) in total house sales (Chart 4). In annualized terms, this share hovered around 20% prior to 2018, started to rise in the tightening episode and reached a historical high of 24.3% in April 2019. Then, the share of firms in house sales fell below 20%, and has not picked up in the recent tightening period. Additionally, this share declined in recent months and stood at 15.6% as of April 2025. An analysis of the data reveals that the recent uptick in total house sales stems from individuals, not firms. Hence, there has been no increase in the firms’ tendency to sell assets to avoid default in the current tightening period.

To sum up, corporate sector default rates did not display a significant increase in the last tightening cycle, which is attributable to firms’ strong financial indicators before the tightening. In fact, house sales of firms have recently hovered below historical averages and their share within total sales declined, supporting our assessment.

[1] The data for publicly traded companies suggest a slight decline in the operating profit margin in 2024.

[2] This can be considered similar to the tendency of manufacturing industry firms to destock manufactured goods.